What is PCORI Reporting?

If you're a customer of Remodel Health offering a MEC plan, you must report the average employee count for 2024 using IRS Form 720 by July 31, 2025. Below is important information about PCORI fees and the filing requirements.

What is the PCORI Fee?

The Patient-Centered Outcomes Research Institute (PCORI) was established as part of healthcare reform to support clinical effectiveness research. Funded partially by fees ("PCORI fees") paid by certain health insurers and self-insured health plan sponsors, PCORI helps patients, clinicians, and policymakers make informed health decisions through evidence-based medicine and clinical research findings.

How Much is the PCORI Fee?

The fee is determined based on the last day of your plan year. Below is the payment schedule for 2024:

| Last Day of Plan Year | Fee per Average Covered Life | Fee Due Date |

| January 31, 2024 | $3.22 | July 31, 2025 |

| February 28, 2024 | $3.22 | July 31, 2025 |

| March 31, 2024 | $3.22 | July 31, 2025 |

| April 30, 2024 | $3.22 | July 31, 2025 |

| May 31, 2024 | $3.22 | July 31, 2025 |

| June 30, 2024 | $3.22 | July 31, 2025 |

| July 31, 2024 | $3.22 | July 31, 2025 |

| August 31, 2024 | $3.22 | July 31, 2025 |

| September 30, 2024 | $3.22 | July 31, 2025 |

| October 31, 2024 | $3.38 | July 31, 2025 |

| November 30, 2024 | $3.38 | July 31, 2025 |

| December 31, 2024 | $3.38 | July 31, 2025 |

How is the Fee Filed?

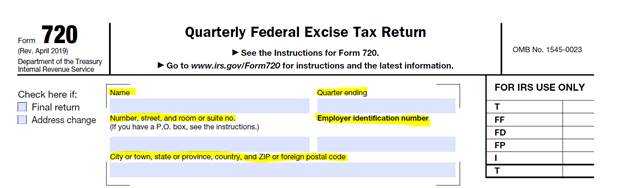

PCORI fees must be reported and paid once a year on IRS Form 720 (Quarterly Federal Excise Tax Return). Reports and payments are due no later than July 31 following the plan year's last day. For instance, for the year ending December 31, 2024, the form must be filed by July 31, 2025. Select the 2nd quarter as the tax period when completing the payment voucher.

How to Complete IRS form 720:

Step #1

Enter your company information at the top of Page 1 and enter June 30, 2019, as the quarter-ending date.

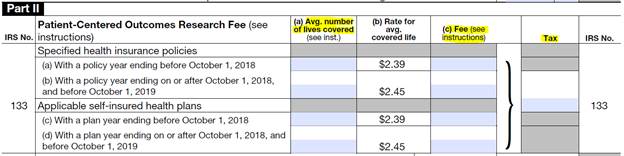

Step #2

On Page 2, Part II:

- Enter your 2024 average employee count on line 133c (if your plan ended before October 1, 2024)

OR line 133d (if your plan ended between October 1, 2024, and October 1, 2025).

Calculate the fee by multiplying the average lives covered by the applicable rate and enter the amount due.

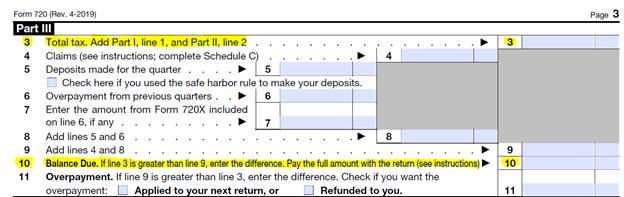

Step #3

Enter the total tax on Page 3, Part III, lines 3 and 10.

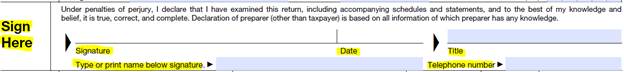

Step #4

Complete the "Sign Here" section at the bottom of Page 3.

Step #5

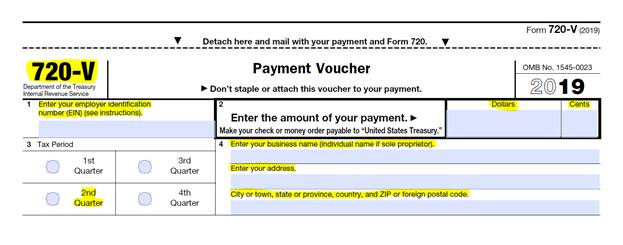

Fill out Form 720-V for 2nd Quarter tax period.

Step #6

Make your check payable to:

United States Treasury

Send the payment, along with Form 720 (pages 1-3) and the payment voucher, to:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0009

Helpful Links

- IRS PCORI Form 720 https://www.irs.gov/pub/irs-pdf/f720.pdf

- IRS PCORI Form 720 Instructions https://www.irs.gov/pub/irs-pdf/i720.pdf

- IRS PCORI Form 720 Information https://www.irs.gov/forms-pubs/form-720-quarterly-federal-excise-tax-return